The following is an overview of the 1st Quarter( January to March) FY12/2022.

=================================================================

Before the presentation, we would like to explain the changes in rules to record the revenues. Adoption of the accounting standard for revenue recognition this year led to the changes in rules to record the revenues. The figures before the changes in rules were presented as “Old standard” and the figures after the adoption of new rules were presented as “New standard” in the results presentation slides.

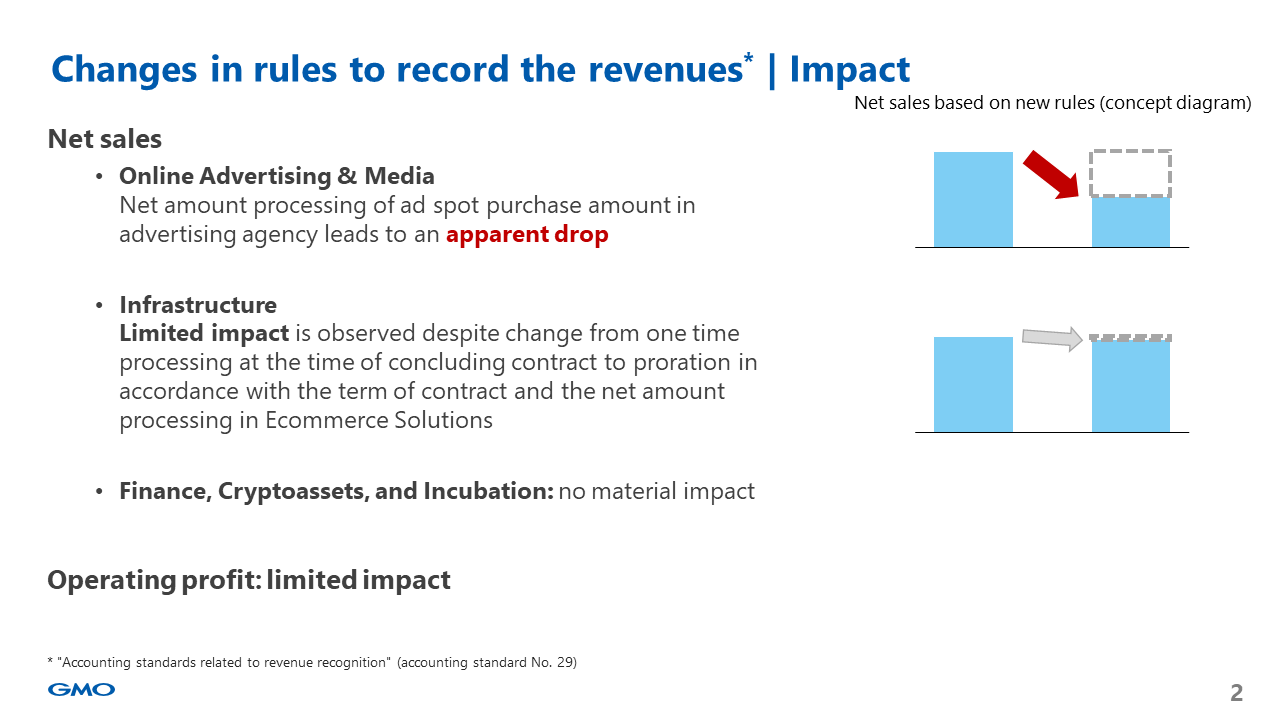

As discussed in the last results presentation, the impact of the new standard is as follows. For Online Advertising & Media, we saw a significant drop in net sales. As for Infrastructure, a limited impact was observed. As for Finance, Cryptoassets, and Incubation, there was no material impact. There was a limited impact on the profit.

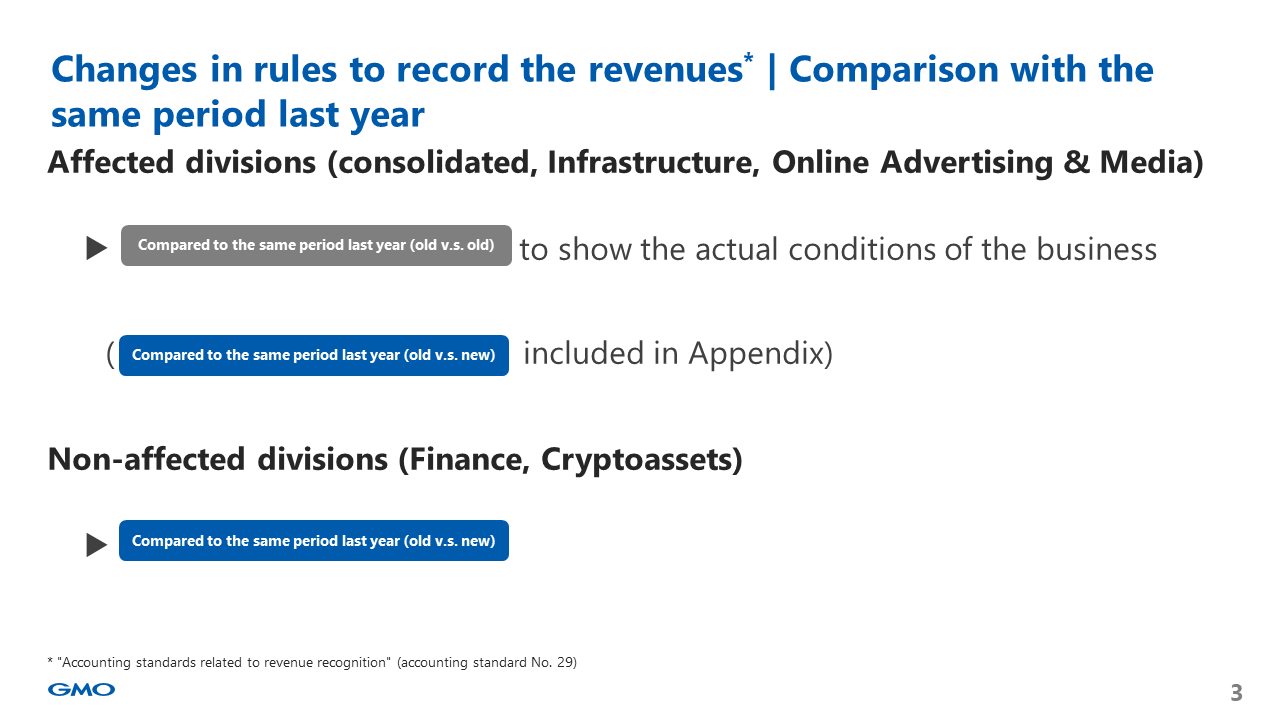

Regarding the comparison with the same period last year, for affected divisions (consolidated, Infrastructure, Online Advertising & Media), using the same old standard yardstick will properly show the current state of business. A comparison between old and new standards is made available in the appendix. As for non-affected divisions, comparative calculations between old and new standards are made.

=============================================

■Financial Overview

=============================================

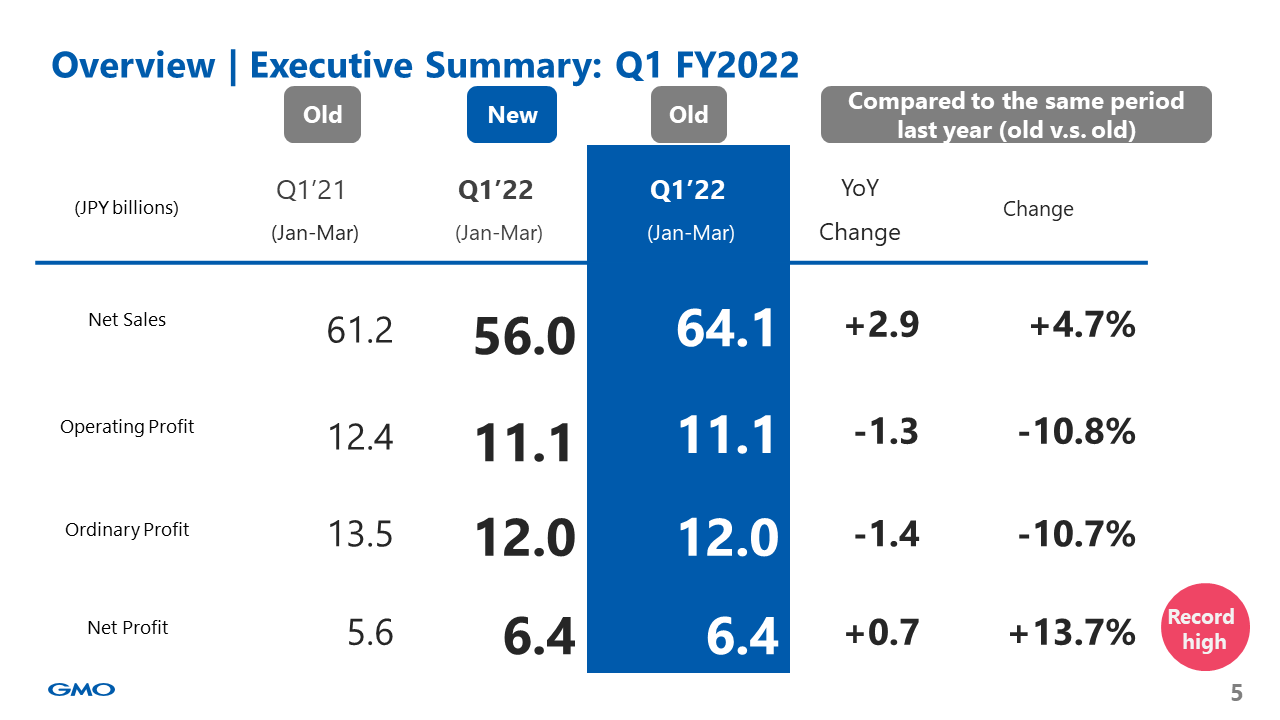

Numbers based on the old standard were as follows: net sales were 64.1 billion yen; operating profit was 11.1 billion yen; ordinary profit was 12.0 billion yen; net profit was 6.4 billion yen. We posted a gain via the sale of investments in securities and the net profit achieved a record high. Revenue was up and operating profit was down year-on-year.

Cryptoassets’ growth was sluggish as compared to the volatile market it saw in 2021. However, for Internet Infrastructure, Advertising, and Media, earnings achieved a record high. The operating profit in Internet Finance exceeded 11 billion yen. Results showed stability of our revenue base.

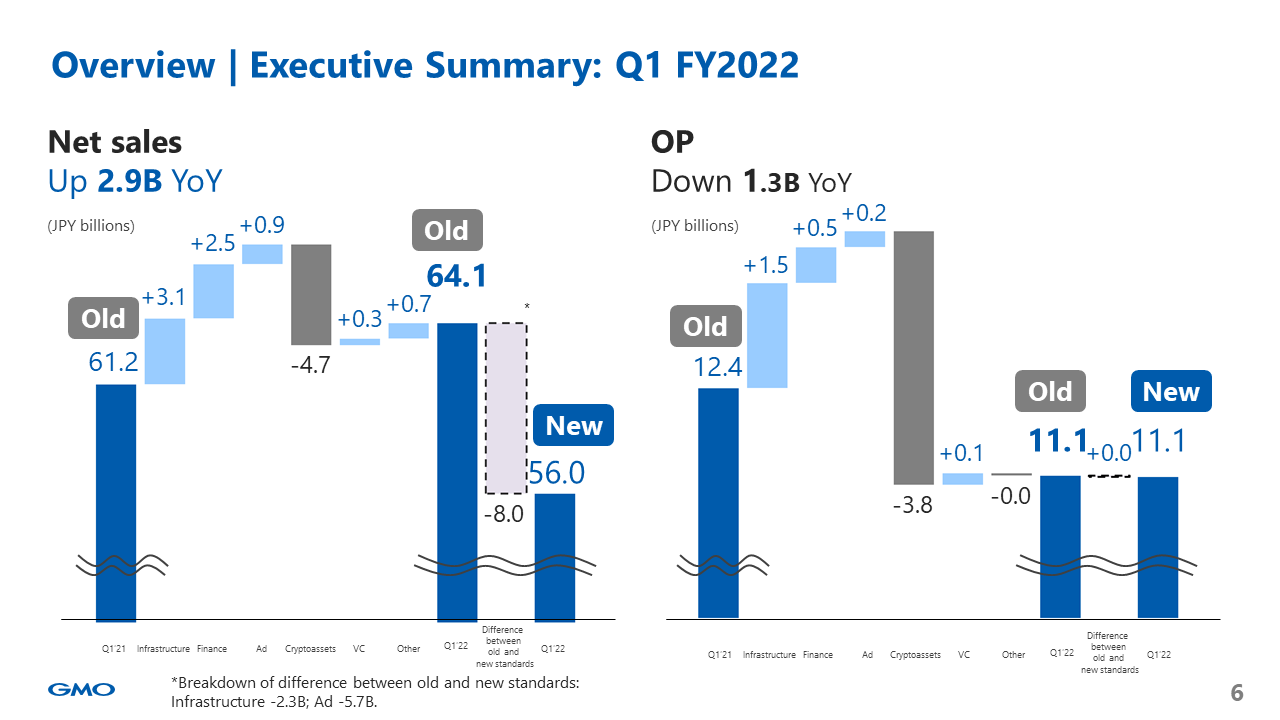

This is an executive summary of the net sales and the operating profit for each segment covering January to March. Based on the old standard, net sales in Infrastructure, Online Advertising & Media, and Finance increased, which offset the decrease in net sales in the Cryptoassets segment. As a result, the net sales were up 2.9 billion yen to 64.1 billion yen year-on-year. Minus 8.0 billion yen due to the changes in standard resulted in net sales of 56.0 billion yen based on the new standard.

This is an executive summary of operating profit in each business area covering January to March. Based on the old standard, we saw profit decrease by 1.3 billion yen to 11.1 billion yen from last year as with net sales. The changes in the standard, which had a limited impact, resulted in a similar amount of profit based on the new standard. Revenue was up and profit was down year-on-year, using the same old standard yardstick.

====================================

■Internet Infrastructure

====================================

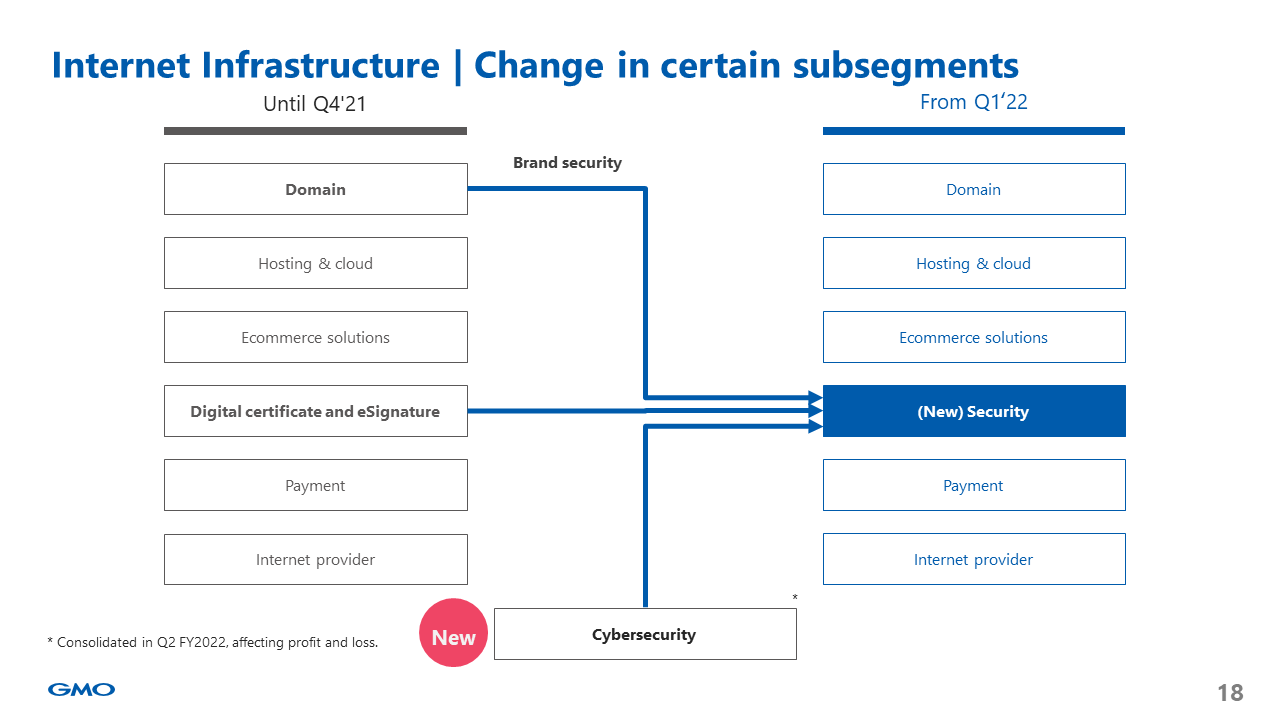

We changed the sub-segments. “Digital certificate and eSignature” was changed to “Security” inside the Infrastructure segment. Brand security business, which was until now included in the Domain business, and the Cybersecurity business (the full-scale entry in January) were transferred to this Security business. The Cybersecurity business will be consolidated in Q2 FY2022, affecting profit and loss.

New “Security” will play important roles in three areas: the cryptosecurity business such as SSL using authentication technologies; the cybersecurity business with Japan’s leading white hat hacker organization; and the brand security business with professionals in the fields of domain and trademark. We will discuss the background of the composition and the future strategies later on.

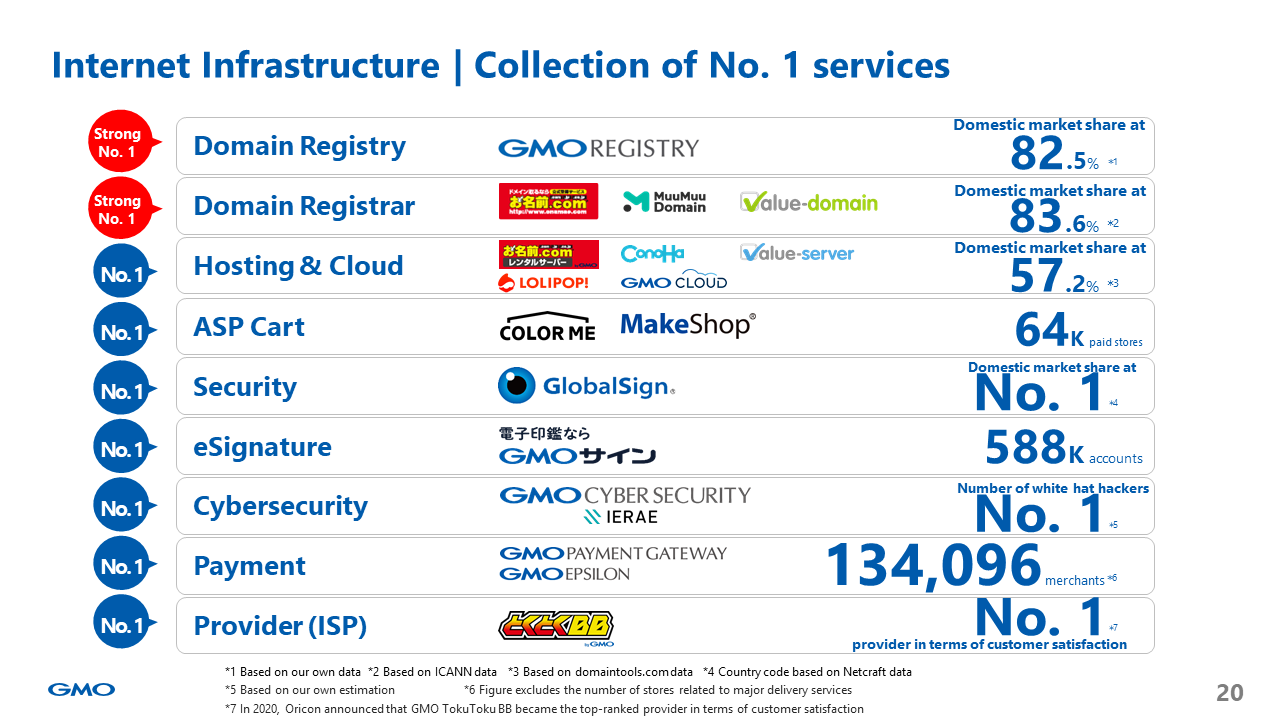

Regarding the business description of the Internet Infrastructure segment, domain, hosting & cloud, ecommerce platform, SSL server certificates, e-contract service, cybersecurity, payment, and provider each hold top share in their respective markets in Japan. They are services that are vital to Internet society that keeps expanding, do not disappear, and fulfill their roles as infrastructure.

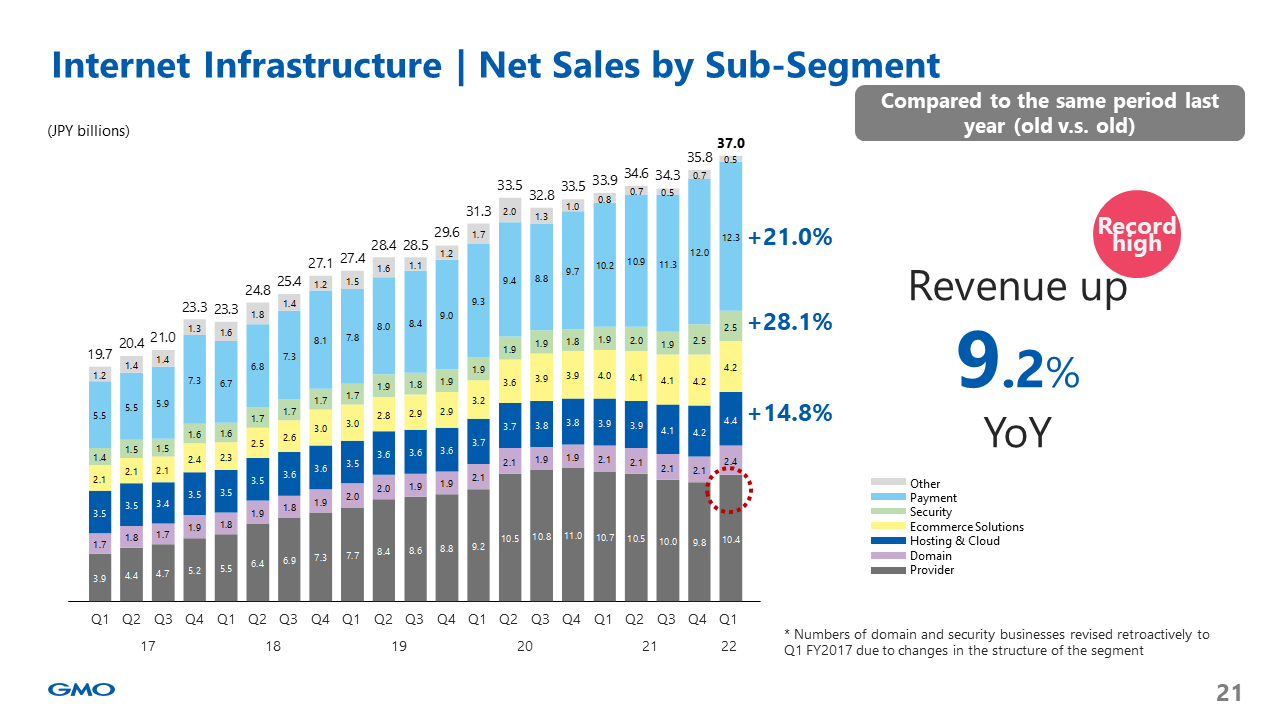

This is net sales based on the old standard and its breakdown. The Internet Infrastructure segment has been growing on an ongoing basis as online consumption has increased and as the segment utilizes the strengths of the No. 1 services. In the payment business shown in light blue, sales of the terminal of stera, the next-generation payment platform offered by GMO Financial Gate, Inc. that plays important role in the offline payment, continue to increase. We expect that stera will generate a significant amount of transaction revenue in the future.

Effect due to change in the SSL expiration date was temporary and Security that is shown in green recovered and is now growing again. Hosting & cloud, especially services for individuals, is doing well and has seen two-digit growth. In addition, in the Provider business shown in gray with a high sales composition ratio, sales increased QoQ. Due to the peak season between January and March, the revision of the products of mobile line service, which has been a challenge, is starting to produce good results.

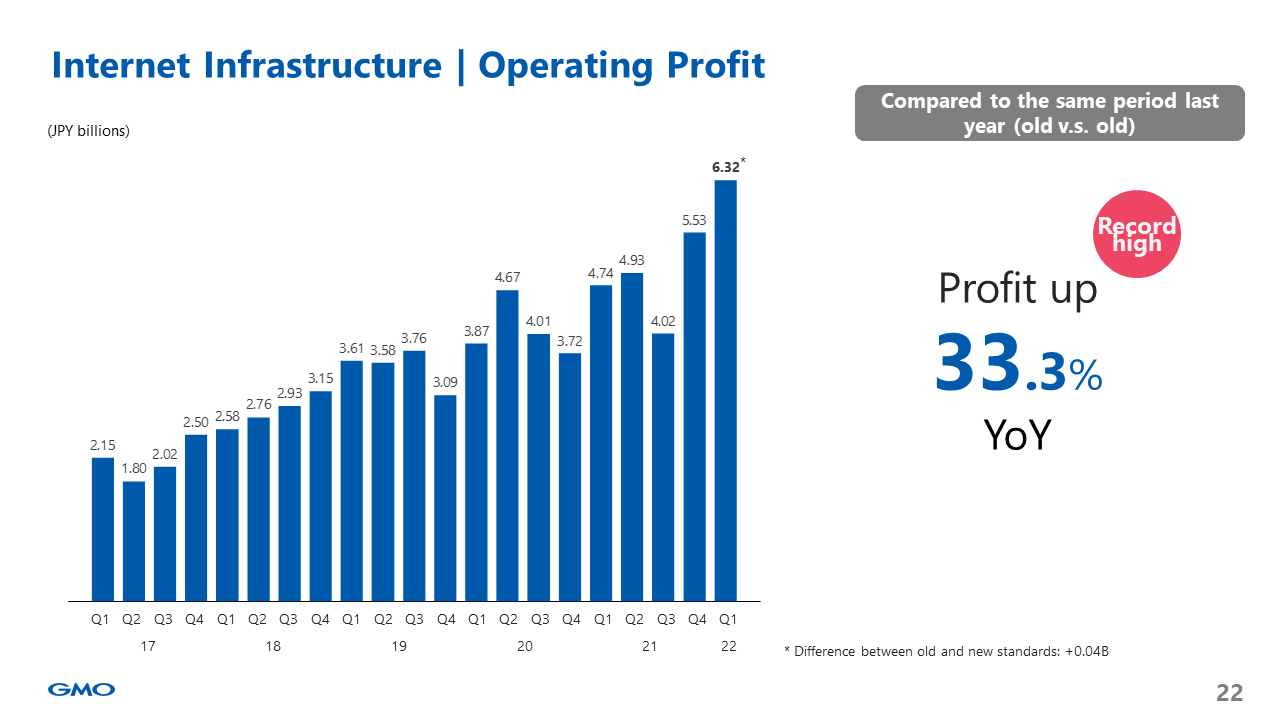

Shown here are the Internet Infrastructure segment’s quarterly profit trends over the past 6 years. Profit has exceeded 5.0 billion yen for the first time in the most recent quarter (from October to December) and exceeded 6.0 billion yen for the first time this year (up 33 percent year-on-year), achieving a record high. We have already entered into the phase where profit in each business area is expanding as the businesses that we have made investments in and grown have entered a profitable phase.

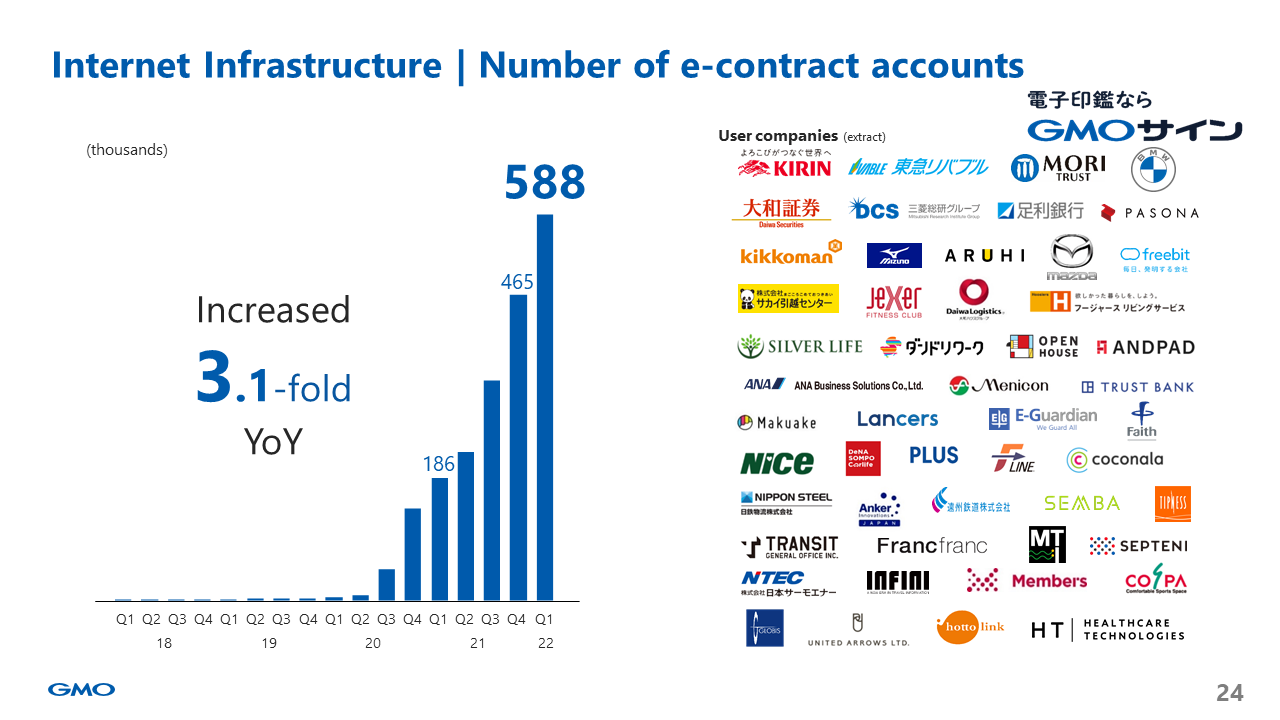

The growth in the e-contract service GMO Sign was significant. After the end of the Goodbye Seal Impression Campaign conducted by the group since the end of June 2020, the domestic market share continued to expand by the “network effect”. The number of accounts was 580,000 as of March 2022, a 3.1-fold increase compared to the same period last year, and was No. 1 domestically. The major enterprises are introducing the GMO Sign.

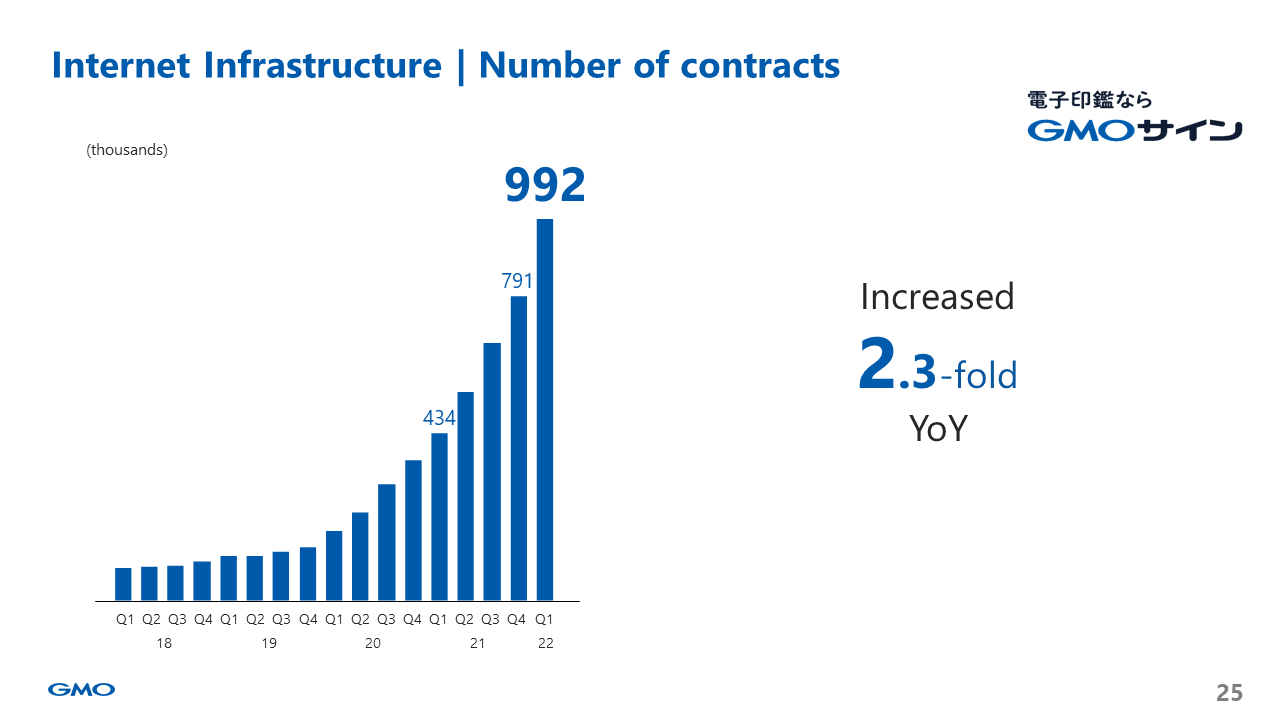

GMO Internet Group is aware that the most important KPI that shows customers’ activity is the number of contracts, which has increased 2.3-fold YoY and is growing steadily. We are aiming to be number one in the country in terms of the number of contracts as well.

Regarding the spread of GMO Sign, we are strengthening partnerships with local governments. As of today, the adoption of GMO Sign by 12 local governments and groups is determined. We plan to support improvement in the efficiency of the business through GMO Sign for Administrative Reform DX.

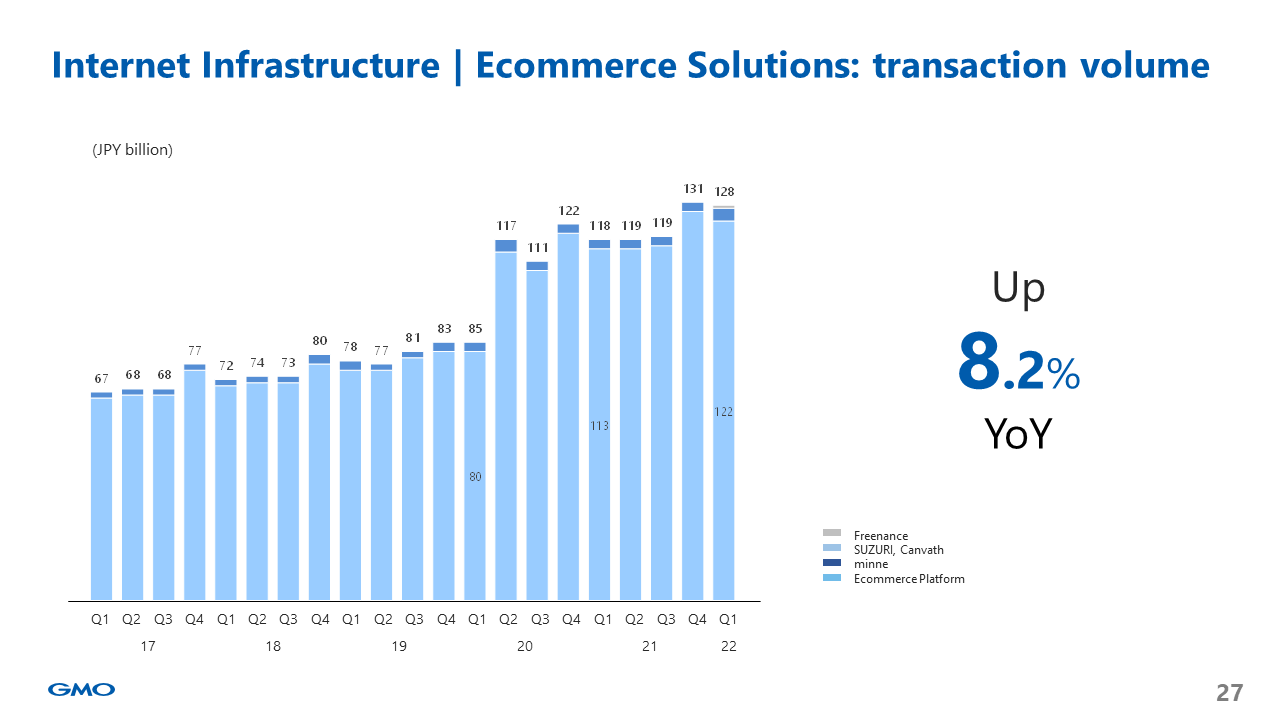

This chart shows transaction volume trends in the Ecommerce Solutions subsegment. The subsegment consists of the services such as minne, SUZURI, FREENANCE, and the ecommerce platform provided by Color Me Shop! and MakeShop. The total transaction volume increased by 8.2% year-on-year, and GMO Payment Gateway’s payment that customers are using comprises approximately 40% of the transaction volume. For the majority of the volume transacted via the payment processing service including credit cards, etc., customers are using other group services, which indicates synergies between the ecommerce platform and the payment business.

====================================

■Online Advertising &Media

====================================

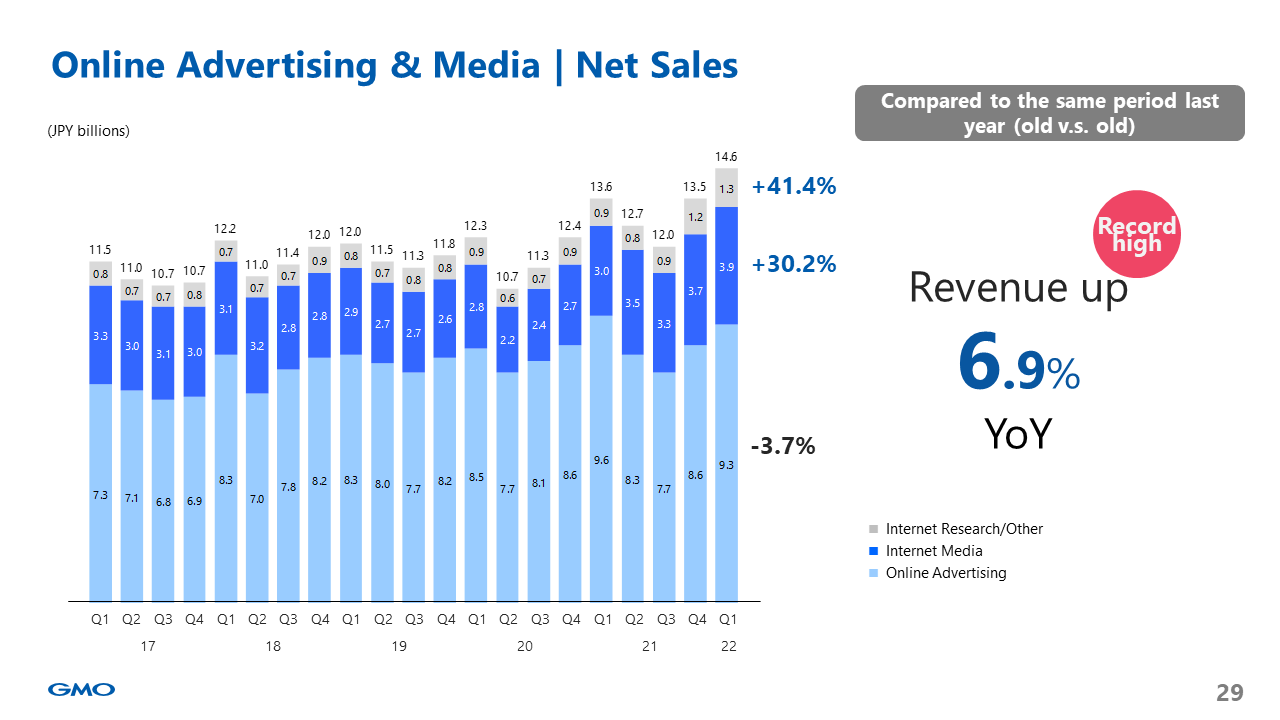

This is net sales based on the old standard and its breakdown. For Advertising, while affiliate advertising grew, standards of ad network advertisement distribution assessment were tightened in Q3 FY2021 and beyond, leading to the weak growth of the revenue. On the other hand, Media performed favorably due to the increasing page views of in-house media. The net sales of GMO Research increased as research platforms for research companies performed favorably.

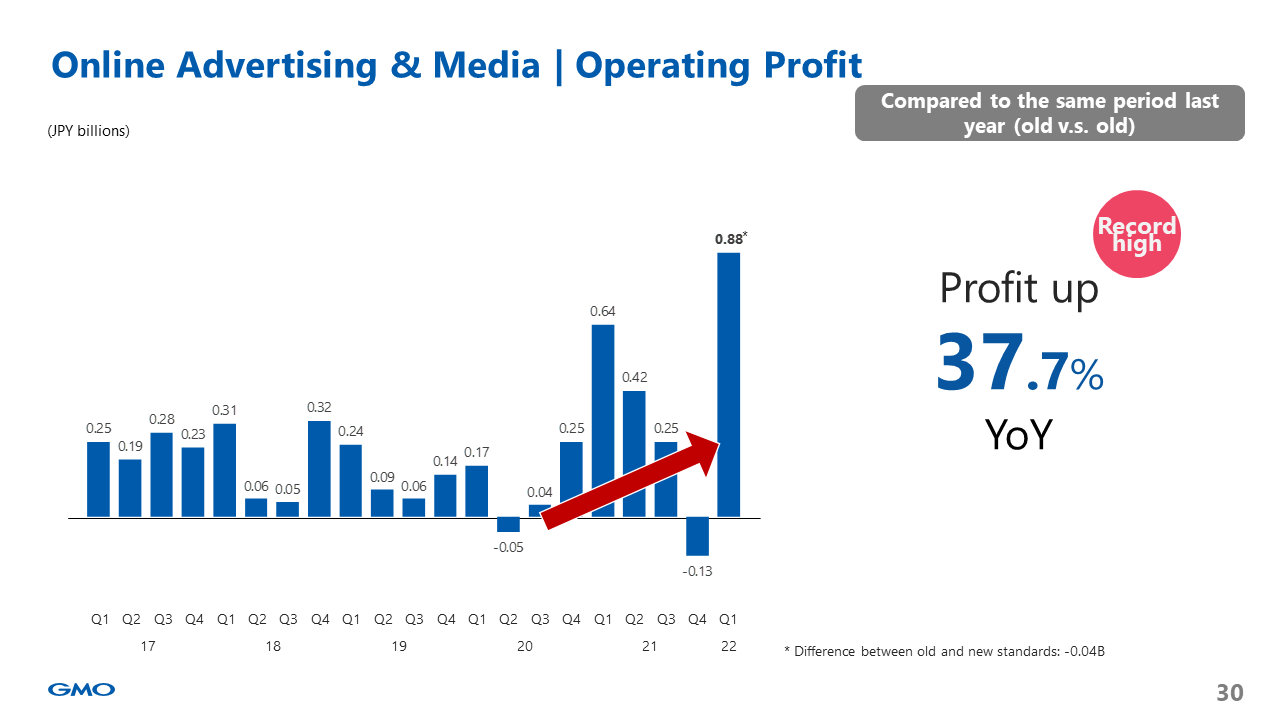

Shown here are Online Advertising & Media segment’s quarterly profit trends over the past 6 years. Profit has bottomed out in 2020 and is now recovering. High-margin in-house products, such as in-house media and research platforms, expanded, and operating profit achieved a record high, which was a modest achievement. We will continue to invest in enhancing in-house products and media.

====================================

■Internet Finance

====================================

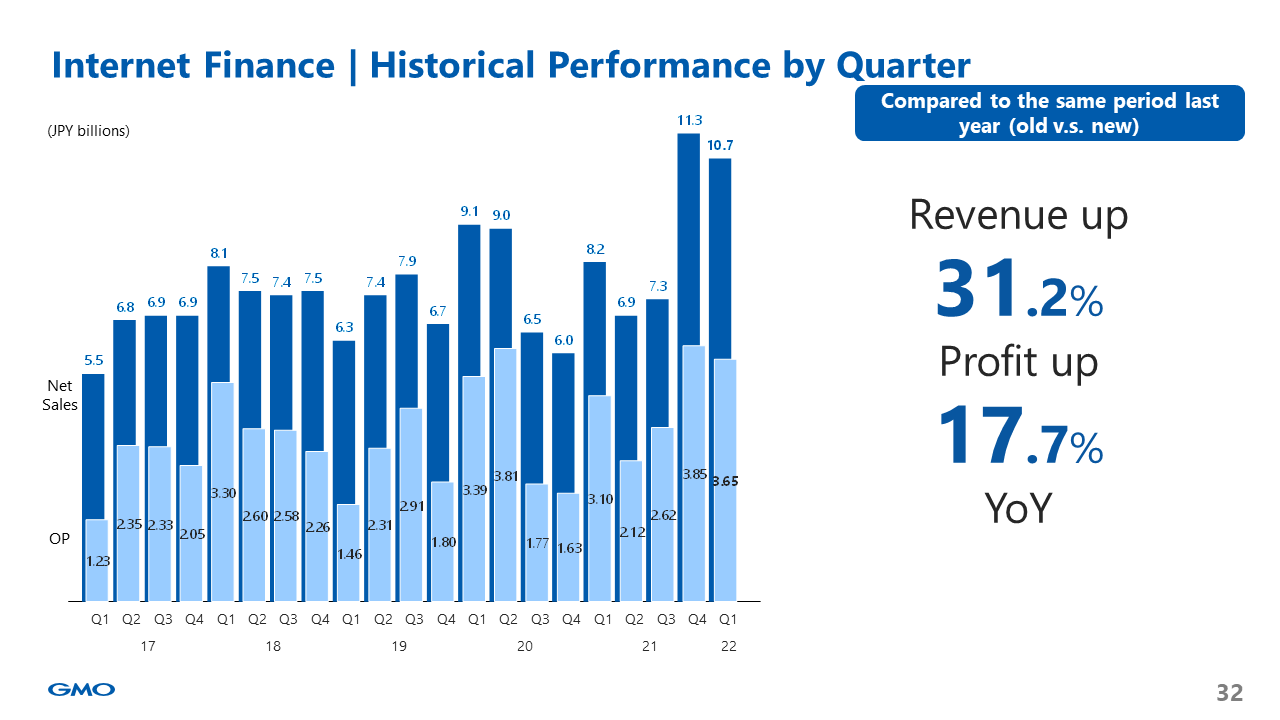

Both revenue and profit were up as a result of Gaika ex byGMO’s joining the Group. Looking at each product, CFDs performed well amid volatile stock and commodity markets. On the other hand, although the volume of FX transactions increased compared to the same period last year, the weak growth of the profit was due to the increasing cover transaction cost.

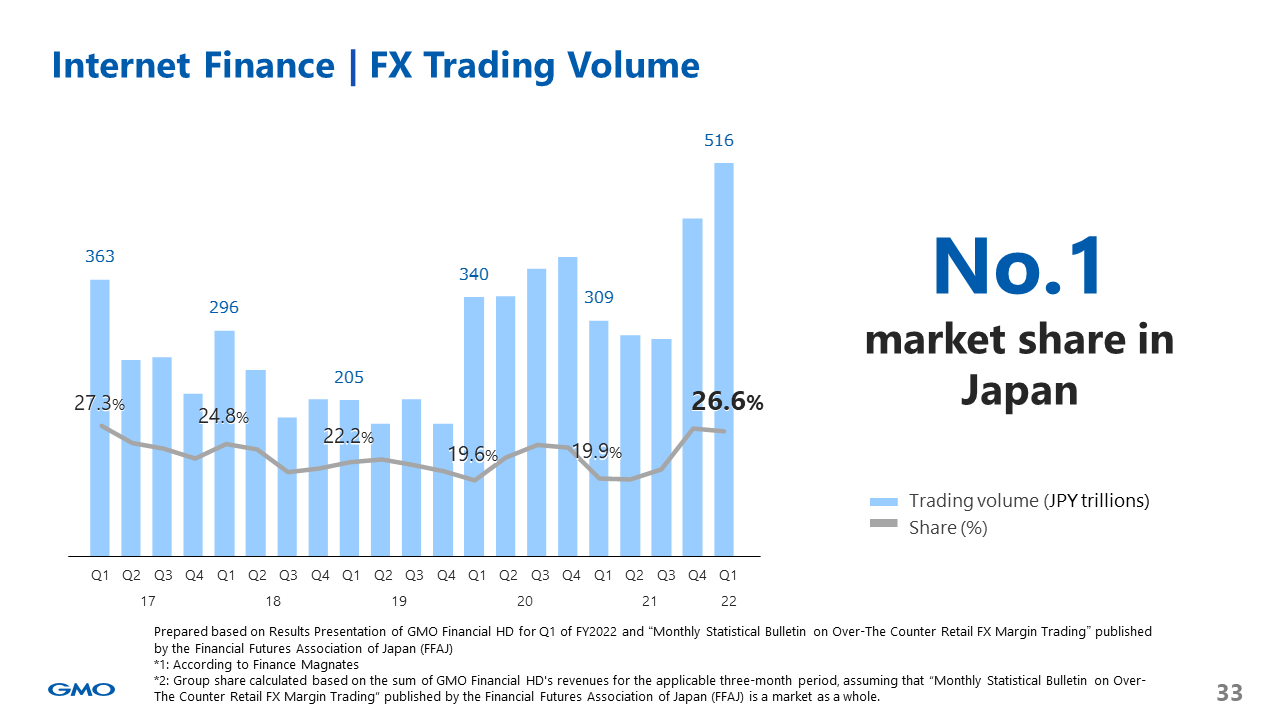

The next slide shows our trading volume and the domestic market share over the past six years. Trading volume has remained high because the new subsidiary joined the Group in Q4 FY2021, because of the weak yen and strong US dollar, and also because the volatility rose. We are aiming to expand the market share and improve the profitability as we continue to explore synergies to become No. 1.

====================================

■Cryptoasset business

====================================

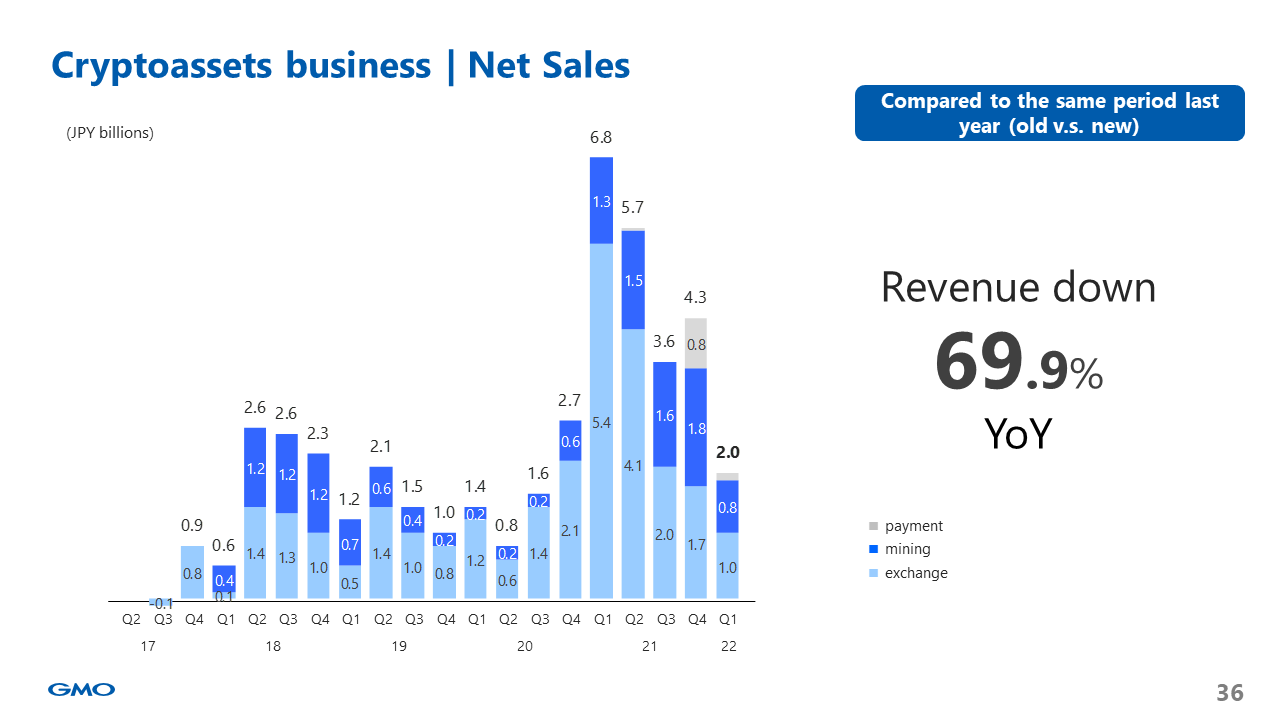

Cryptoassets business operates the following three services: mining; exchange; and payment.

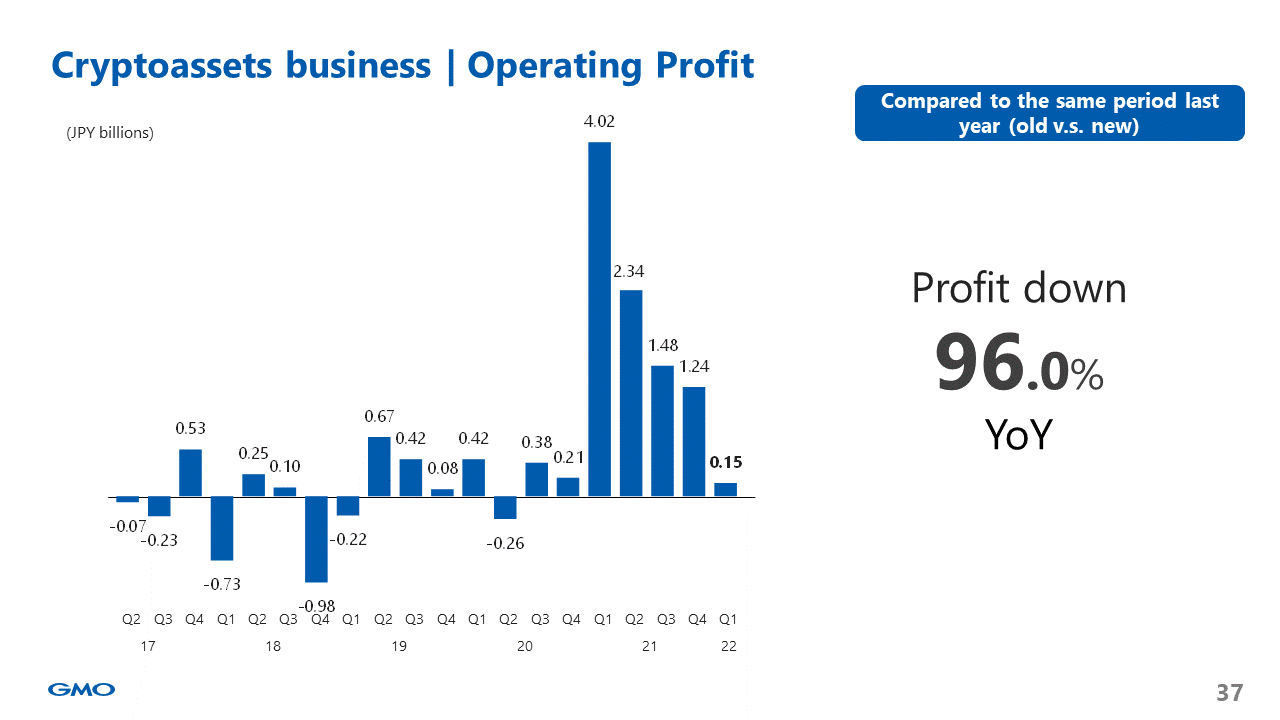

The volume of transactions in the cryptoassets exchange business continues to see a downward trend as a result of a decline in volatility following the volatile cryptoassets market in the first half of 2021. On the other hand, market share in Japan and the consumer base, such as customer accounts and assets in custody, are expanding, and a management system has been built to generate profit at an appropriate time. In addition to the temporary decline in the number of computers operating in the data center, the mining business’ growth was sluggish compared to the previous quarter due to external factors such as crypto asset prices and global hash rates.

OP dropped significantly compared to the same period last year as the exchange business’ OP dropped – though mining is still in the black. Regarding GMO Coin, we intend to operate in a way that reduces marketing investment due to the market environment.

====================================

■Strategic efforts

====================================

The composition of the area of security

That cyberattacks have become increasingly sophisticated is a social issue. While the progress of the digital shift makes life more convenient, you may feel that cyberattacks are increasing. We often hear the following words in the news. Ransomware attacks on large companies, an increase in malware called Emotet, targeted attacks, and supply chain attacks. For individuals, phishing scams, fraudulent use of credit card information, etc. They are countless. As the government calls attention to cyber security measures, the risks to information security are increasing day by day.

Under such circumstances, GMO Internet Group will contribute to the realization of a safe nation and society by raising “Secure and Safe Internet for Everyone” as a corporate slogan in an effort to meet the needs for security, which will accelerate further in the future with the progress of the DX and digitalization.

“Security” will comprise the following three pillars: the cryptosecurity business such as SSL using authentication technologies; the cybersecurity business with Japan’s leading white hat hacker organization; and the brand security business with professionals in the fields of domain and trademark. Next is the strength of each business.

- Cryptosecurity

GMO GlobalSign develops globally the only Japanese Certificate Authority and offers services utilizing encryption technology, mainly digital certificates and electronic seals, globally. GMO Internet Group’s advantages are that GMO GlobalSign has managed digital certificates for many years and is in a business with high barriers to entry.

Creating a Certificate Authority requires a great deal of technical skill but it is not absolutely impossible. However, the Certificate Authority alone is not enough, and it must be recognized by browser companies and included in all the equipment such as personal computers, smartphones, and pads that are now widely used. Having both is physically possible but in reality, it may require 10 years. Therefore, this is our strength and how we differentiate ourselves from others.

2.Cybersecurity

We’d like to share details about the new company GMO Cybersecurity by Ierae, Inc. that joined the Group, as we announced in January. Ierae is the leading group of white hat hackers in the country based on the Fermi estimate. The greatest strength of Ierae is its technological capabilities. “Vulnerability diagnosis” performed by white hat hackers who have an “attacker’s point of view” has a track record in a wide range of industries in Japan and overseas. Mr. Makita, the president, is also a white hat hacker and has a high track record in domestic and overseas hacking contests. Ierae is a group of professionals in the field of cybersecurity. In addition to providing the highest quality services, Ierae creates a paradise for engineers – a working environment where all engineers can feel comfortable – and has been recognized as a company that treats its employees well in 2021.

3.Brand security

With the spread of DX and digitalization, brand protection on the Internet has become essential for companies, and the movement is expected to accelerate in the future. GMO Brights Consulting changed its name to GMO BRAND SECURITY Inc. on May 11, 2022. As a group of professionals in the fields of trademark and domain name, we will specialize in brands and provide solutions for brand damage

A safe and secure Internet. GMO Internet Group, which develops cryptosecurity, cybersecurity, and brand security, will strive towards the only business group that is listed to solve security challenges. Please look forward to future developments.

▽back to presentation materials (here)

▽back to historical summery (here)