【IR】GMO Internet Group Strategy 2018 Q2 Summary

We have announced the 2nd quarter financial results for the year ended December 31, 2018.

Results presentation materials (here)

(IR) Masatoshi Kumagai talks about GMO Internet Group Strategy

(IR) GMO Internet Group Strategy 2018 Q1 Summary (here)

Older business results (here)

=============================================

■Financial Overview

=============================================

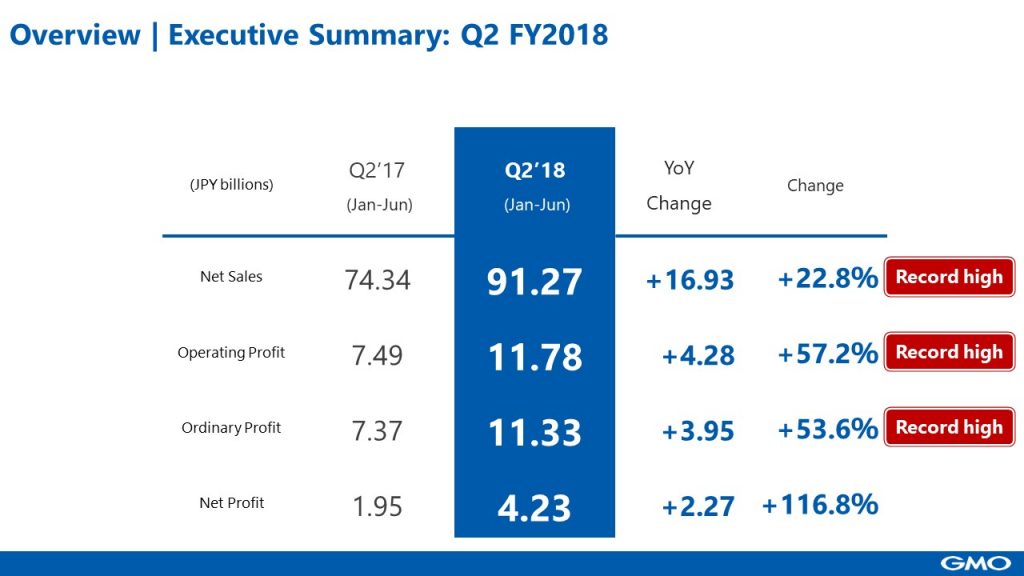

In addition to recurring revenue, there’s been a steady growth in new businesses and incubation business, and net sales, operating profit, and ordinary profit achieved a record high for the second quarter.

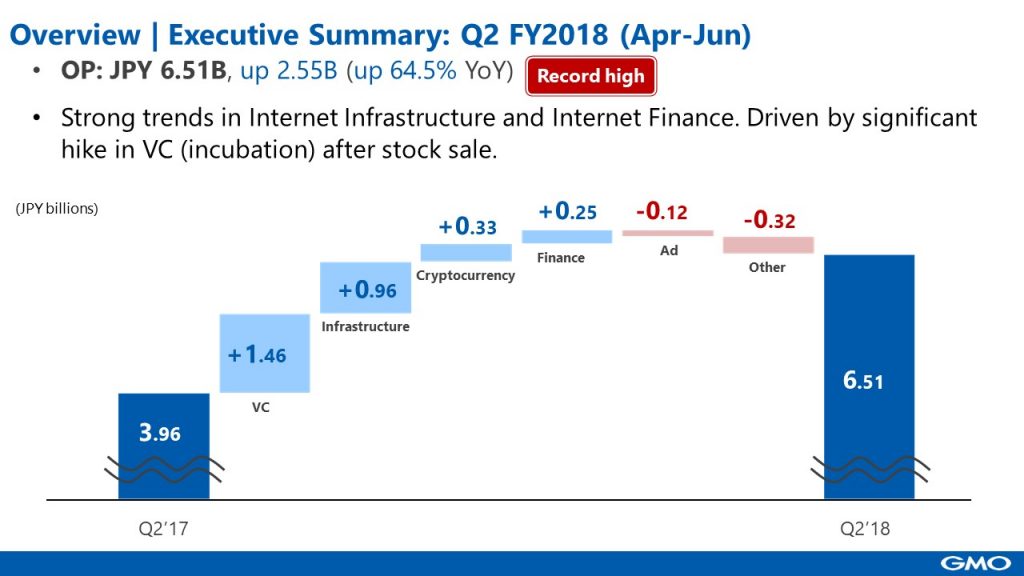

[Executive Summary: Q2 FY2018 (April-June)]

In Infrastructure, operating profit increased by 960 million yen, reaching a record high. In Internet Finance, FX trading volume’s growth was sluggish but operating profit increased by 250 million yen through improvements in FX profitability. In Cryptocurrency, operating profit increased by 330 million yen. In Incubation, operating profit increased by 1.46 billion yen as investees have achieved IPOs. Congratulations to Mercari and Raksul! In Online Advertising and Media, operating profit decreased by 120 million yen due to the impact of ad fraud issues. Operating profit increased by 2.55 billion yen to 6.51 billion yen compared to 2017, and consolidated quarterly earnings achieved a record high.

[Executive Summary: Q2 FY2018]

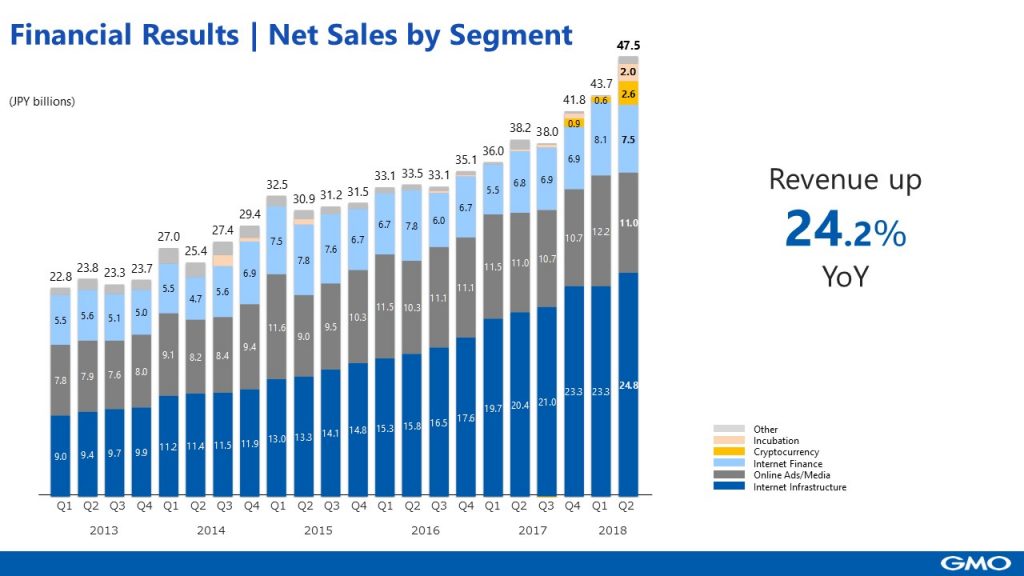

The above graph shows the growth of quarterly net sales by segment. The growth rate has accelerated since 2017, and net sales doubled over the past 5 years.

=============================================

■Internet Infrastructure

=============================================

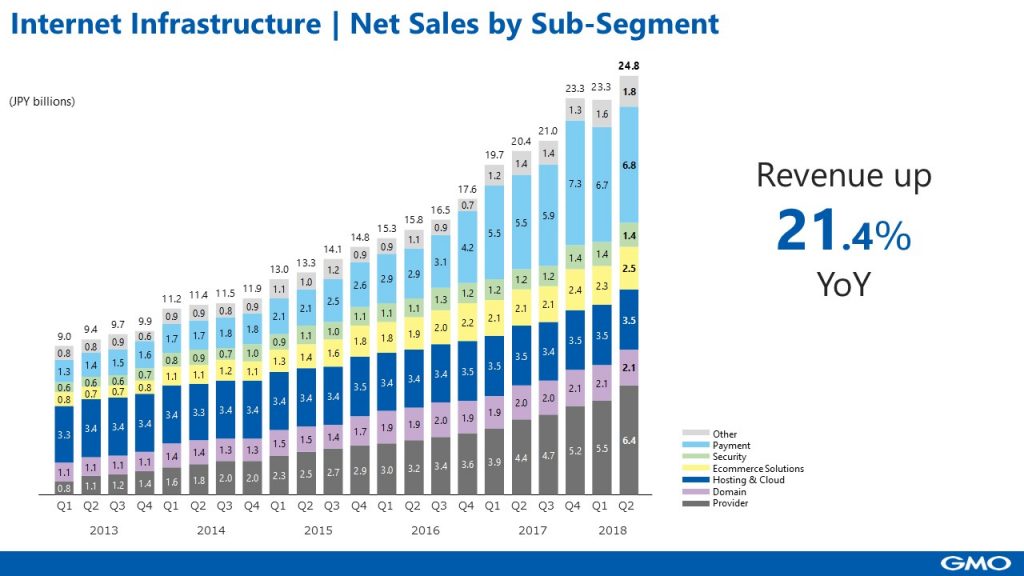

In Internet Infrastructure, solid revenue consisting of the following 2 factors continues to see an upward trend, and revenue doubled over the past 3 years.

- Recurring revenue from infrastructure platforms, such as domain and hosting & cloud, collecting fees every month or every year

- Growth due to the increase in the payment transactions for ecommerce and public money, and enhanced security of the Internet.

=============================================

■Online Advertising & Media segment.

=============================================

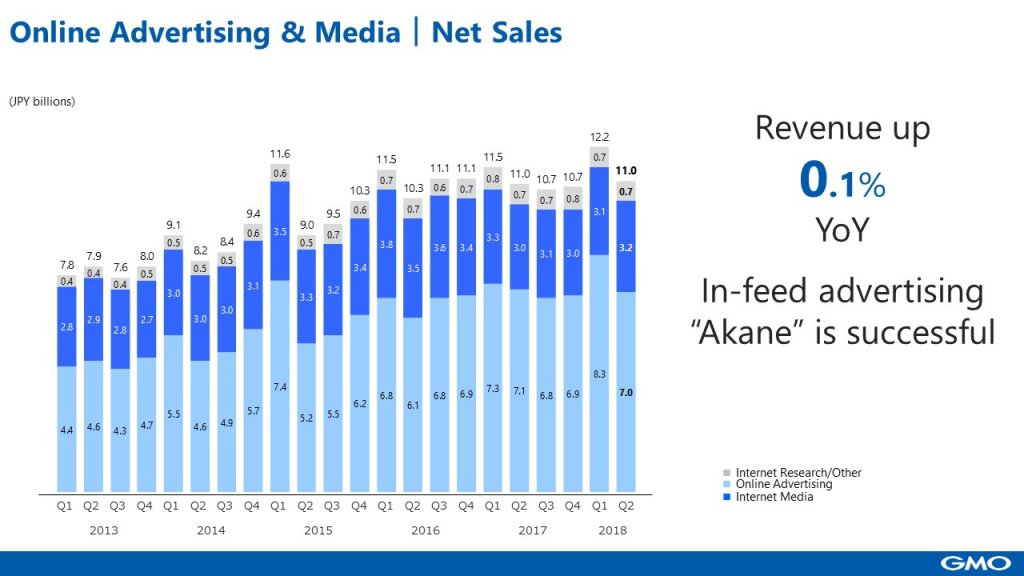

Due to the effect of ad fraud issues and advertisement distribution regulations, market continues to be competitive, while in-feed ad “AkaNe” for smartphone grew. We will continue to strengthen our in-house products while adapting to harsh market conditions.

=============================================

■Internet Finance segment.

=============================================

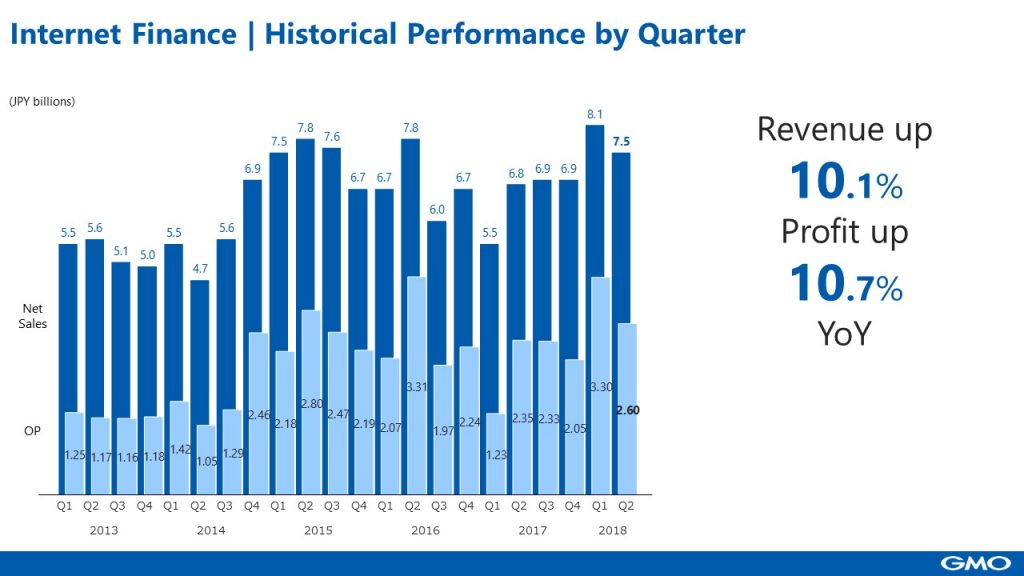

In Internet Finance, we saw two-digit growth in the net sales and profits compared to last year. Profitability is improving through analysis of big-data despite the impact of decreased FX transaction volume compared to Q1. Strong trends in Internet Finance are maintained.

=============================================

■Cryptocurrency segment.

=============================================

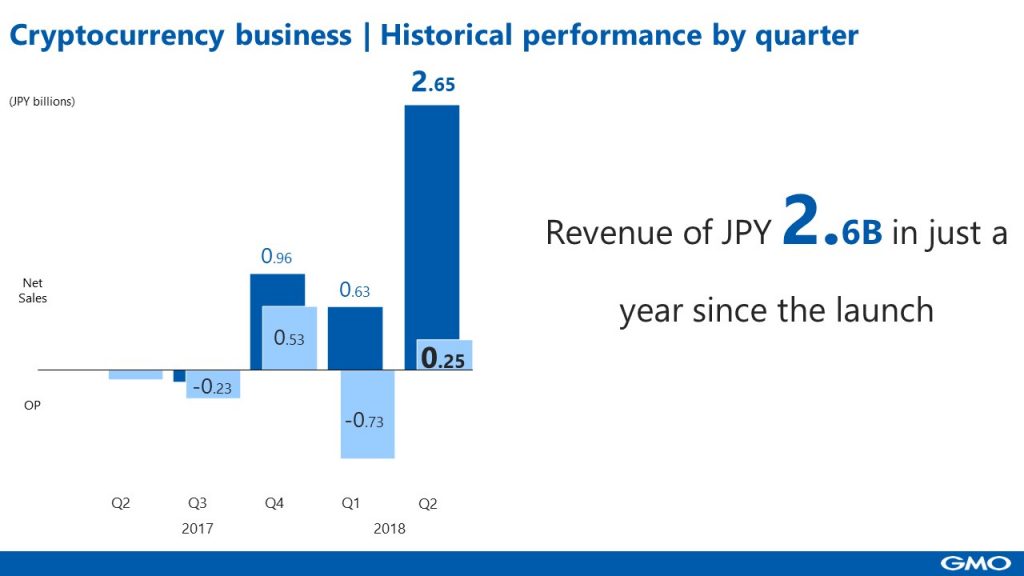

Our cryptocurrency business launched in May and quarterly net sales is growing rapidly, reaching 2.6 billion yen in just a year. In Internet Finance, quarterly net sales reached 7.5 billion yen in 13 years, whereas in Internet Infrastructure, it reached 25 billion yen in 23 years. Cryptocurrency is like gold, and we believe that our cryptocurrency exchange and mining businesses have a high potential for increasing the corporate value in the future.

=============================================

■Cryptocurrency segment: Cryptocurrency exchange business

=============================================

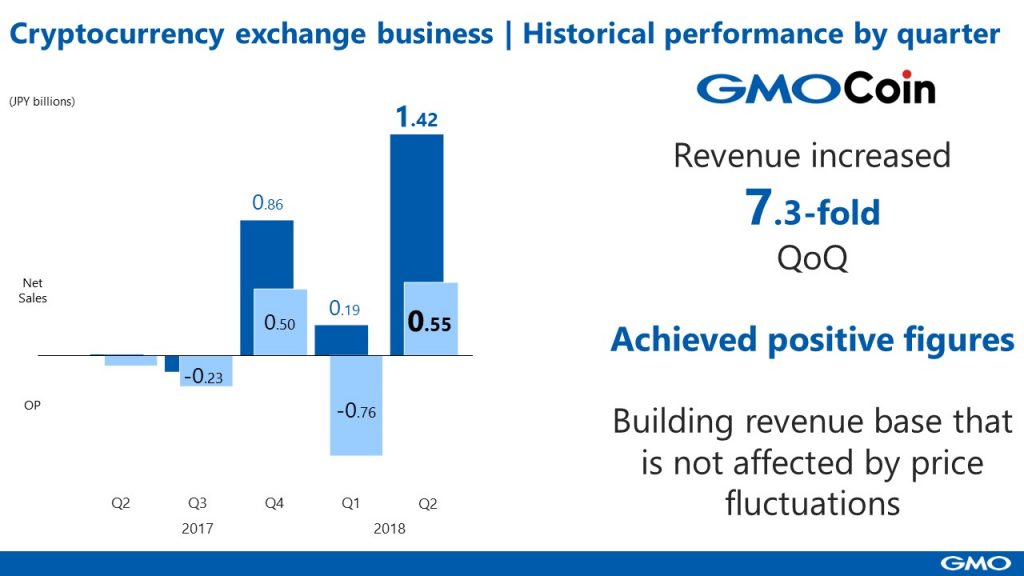

GMO Coin, which is a consolidated subsidiary of GMO Financial Holdings, is at the core of this subsegment. Both revenue and profit were up compared to Q1. GMO Coin offers a spot trading and a trading with a leverage. The business model of GMO Coin is the same as that of GMO CLICK Securities’ FX trading. The adjustment of proprietary positions and cover deals is producing good results. Our aim is to build a revenue base that is unlikely to be affected by volatility.

=============================================

■Cryptocurrency segment: Cryptocurrency mining business

=============================================

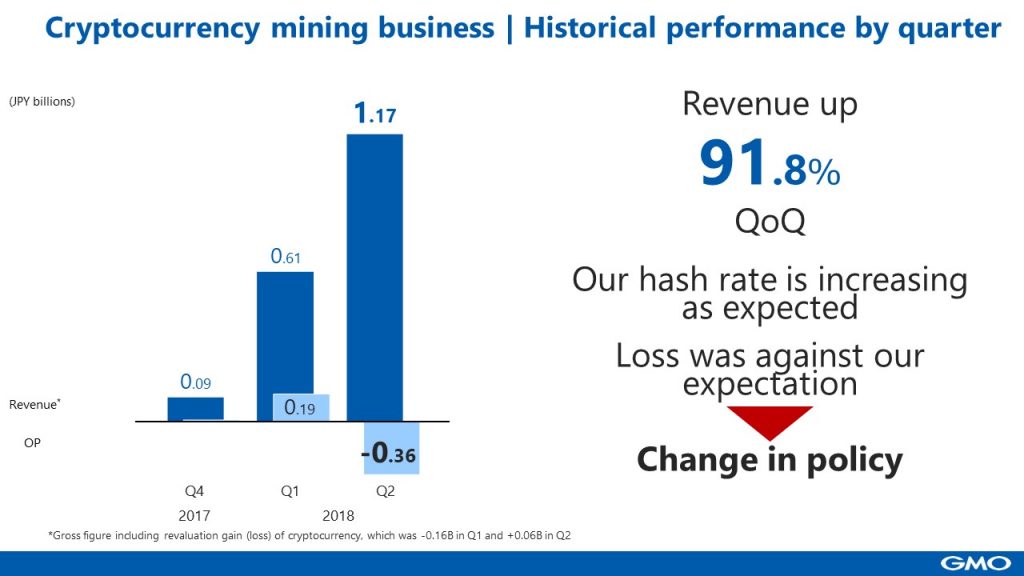

From April to June, we had added mining facilities as planned, and net sales expanded to 1.17 billion yen. Profits were negative, which was unexpected, due to various factors, so we changed our previous policies. While the Bitcoin price since the end of 2017 has been low, the market has become increasingly competitive. The business model of GMO Internet Group’s cryptocurrency business is the same as that of our competitors. At GMO Internet Group, it was decided to direct the effort toward early payback by supplying machines to miners (i.e. mining operators). In the cryptocurrency service, responding flexibly to the market environment is one of the most important things to win in the competition.

GMO miner B2 (currently, B3) was released in June, and orders went beyond our assumption. We will continue to focus on the management, working towards shipping the products in October. Please refer to “Masatoshi Kumagai talks about the GMO Internet Group strategy” for the details.

We launched GMO Aozora Net Bank on July 17. Click here to see the details of the press conference held on the above date. Banking service will become a hub of all the solutions provided by the Group. We are not just unleashing synergies between businesses. In addition to quickly realizing services for customers in each area, the Group will help enrich people’s lives with the new financial services.

We appreciate your ongoing support of the GMO Internet Group.

Internet for Everyone

Results presentation materials (here)

(IR) Masatoshi Kumagai talks about GMO Internet Group Strategy

Older business results (here)